Online credit cards for poor credit can be obtained for a low annual payment and 2% cashback for purchases. This type of card is great for building credit. These cards send monthly reports to all major credit bureaus. It is important to responsibly use the card once you have it. It will help you build your credit score once again by paying your bills on time and being careful with your account.

Common questions regarding credit cards for 500 credit scores

People with a credit score of 500 or lower often have a tough time getting approved for loans or credit cards. Because of their poor credit history, these individuals are considered a higher risk for lenders. These people still have options. You can still get credit cards even if you have 500 credit points.

For those with 500 credit scores, a secured credit credit card may be an option. Many cards come with no annual fees and reward you for your purchases. They can help with credit repair.

For people with poor credit, unsecured credit cards may be better

There are two types of credit cards: secured and unsecured. Secured cards require a security deposits from applicants, while unsecured cards do not. While unsecured credit cards are better for people with bad credit, they often come with sky-high APRs and hefty fees. Before you decide on which credit card for you, you should check your credit score.

Chase Freedom Unlimited is a good example for a unsecured credit card suitable for people with low credit ratings. This card is designed for students. It offers 1.25% cashback for on-time payments and a student discount. The card was designed for students who don't have a lot of credit history but can still afford the monthly fee. It also has a helpful assistant to keep track of your due dates.

Requirements to obtain a credit-card with a 500 credit history

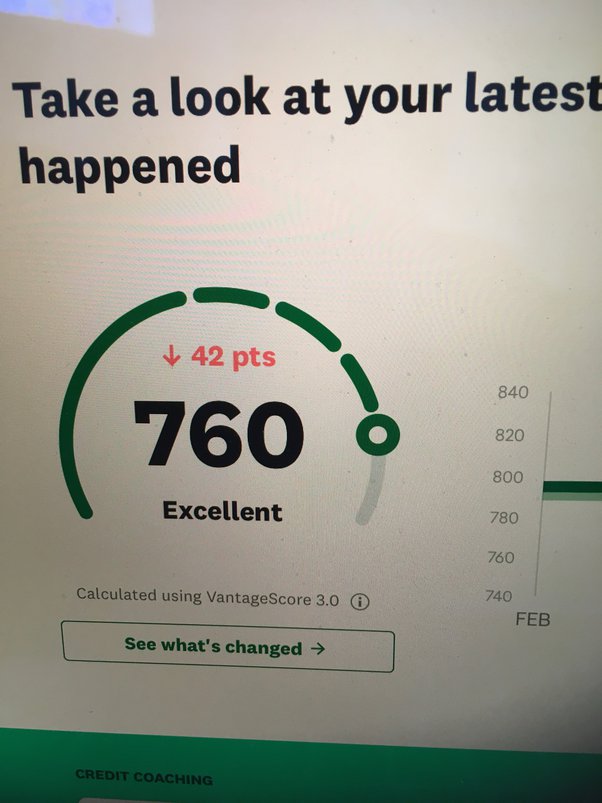

If your credit score falls below 500, it may be difficult to apply credit cards. To increase your chances for approval, you should improve your credit score. Higher credit scores mean more credit card options and lower interest rates. You also have a greater chance of approval if you have fewer collateral requirements.

Even though a credit score below 500 is considered poor, you can still obtain a decent credit card and repair your credit over time. Start by choosing a card that reports your credit history to major credit bureaus. It is important to avoid missing payments, and to keep your credit utilization low. These are key steps that will help you improve credit scores in a matter of months.

Credit card with a 500 credit history offers rewards

It is possible to find a credit line for someone with a 500 credit score. However, it can be more difficult than for someone with a higher score. Credit scores below 600 are considered "poor" and 500 is considered "very poor". Although it is possible to have a low credit score, poor credit can be a problem. There are some key steps you can take in order to improve your credit rating.

A secured card can be an option. This card usually has no annual fee, and it rewards cardholders with 1 to 2.2% cash back on purchases. A secured credit card can help you rebuild your credit rating. These types of cards also report your purchases to the major credit bureaus monthly, giving you a good chance of getting approved. As long as you use your credit card responsibly, you will be on the road to good credit. To repair your credit, it is essential to pay all your bills on time.