The Avant credit card can be a good option for consumers with mediocre or bad credit. This unsecured card reports to all three major credit bureaus, doesn't require a security deposit and starts with a low credit limit (around $300).

The website has an application form that you can fill out to apply for the Avant Card. The company looks at your finances to see if it's possible for you to get the card. The application is quick, taking about 60 seconds.

Avant gives you the flexibility to use your account anytime, day or evening. You can manage your accounts through a mobile or web platform. Autopay is also available.

The card also allows you to monitor your account 24/7 so that it is always clear where your money goes and how it's used. It also doesn't charge foreign transaction fees, so you can shop abroad and make purchases in the currency of that country without paying additional charges.

Acceptance for an Avant card can be easy. The company looks at your income, bill payment history and other factors to determine if you qualify for the credit line you're offered.

You can increase your credit limit in six months. You can link your card to a checking or savings account and set up automatic payments.

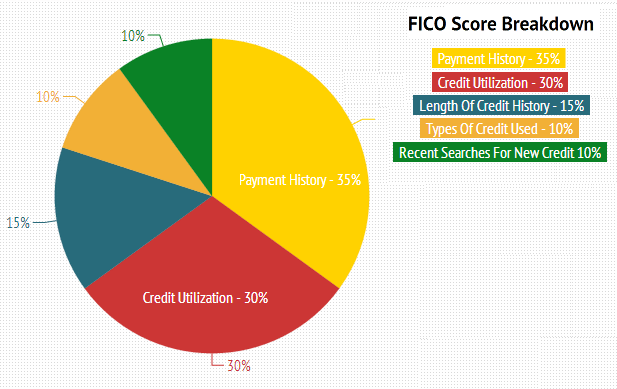

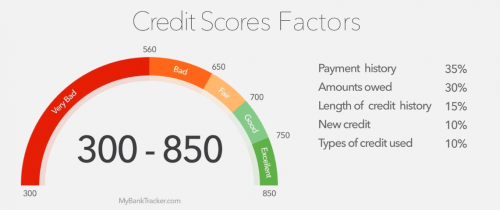

If you pay on time and do not spend your balance, then your credit line could be increased. This extra breathing room helps you maintain a lower debt to credit ratio and improves your credit score.

You may also be eligible for a credit line increase if you haven’t used your card in the last six months or more than a full year. These reviews will be posted on your account dashboard as well as the card's website.

The Avant card can be approved even if you have a bad credit rating, although it will take longer. The company will evaluate your account and upgrade your credit limit, which could be as high as $3,000

The only downside to the Avant credit card is that you won't receive sign-up bonuses or welcome offers with this card. The $59 fee per year is still low in comparison to other unsecured credit cards.

Another positive feature is that the company shares your account data with all three credit bureaus. The card can help you to improve your credit score, but only use it on essentials and not expensive items or services.

The Avant card cannot be used to buy a house or car. You will need a valid ID and proof of income to open an Avant credit card.

Like with any other credit card, it is important to pay on time. This helps you avoid charges and interest. It is important to not exceed the credit limit of your Avant card.