Consider these factors before applying for a credit line. It is important to be aware of the potential impact of a recent credit card application on your credit score. You can also take steps to increase your chances of approval. A low credit score isn't necessarily a problem, but it can make it more difficult to be approved. If denied, you can always request a reconsideration. You must show that you are able and willing to manage your credit responsibly.

It is important to apply for pre-application before you actually apply

Pre-application is as important as the actual application process when applying for credit cards. It's important that you do some research before applying for credit cards. Bad decisions can be a problem for many years. Most major credit card issuers offer prequalifying applications that can help you narrow down your options. Pre-qualifying requests do not affect your credit rating.

Many lenders will receive lots of applications. They may have to spend more time reviewing them. In addition, certain credit cards may be more in demand than others, thus attracting more applicants. You should also make sure that you compare different credit cards to find the best deal for you. You will receive an application decision from almost all lenders via mail. Make sure to keep your mailbox clean. If you get an email from a lender, be sure to check your spam mailbox.

Before applying for a credit line, there are some things you should consider

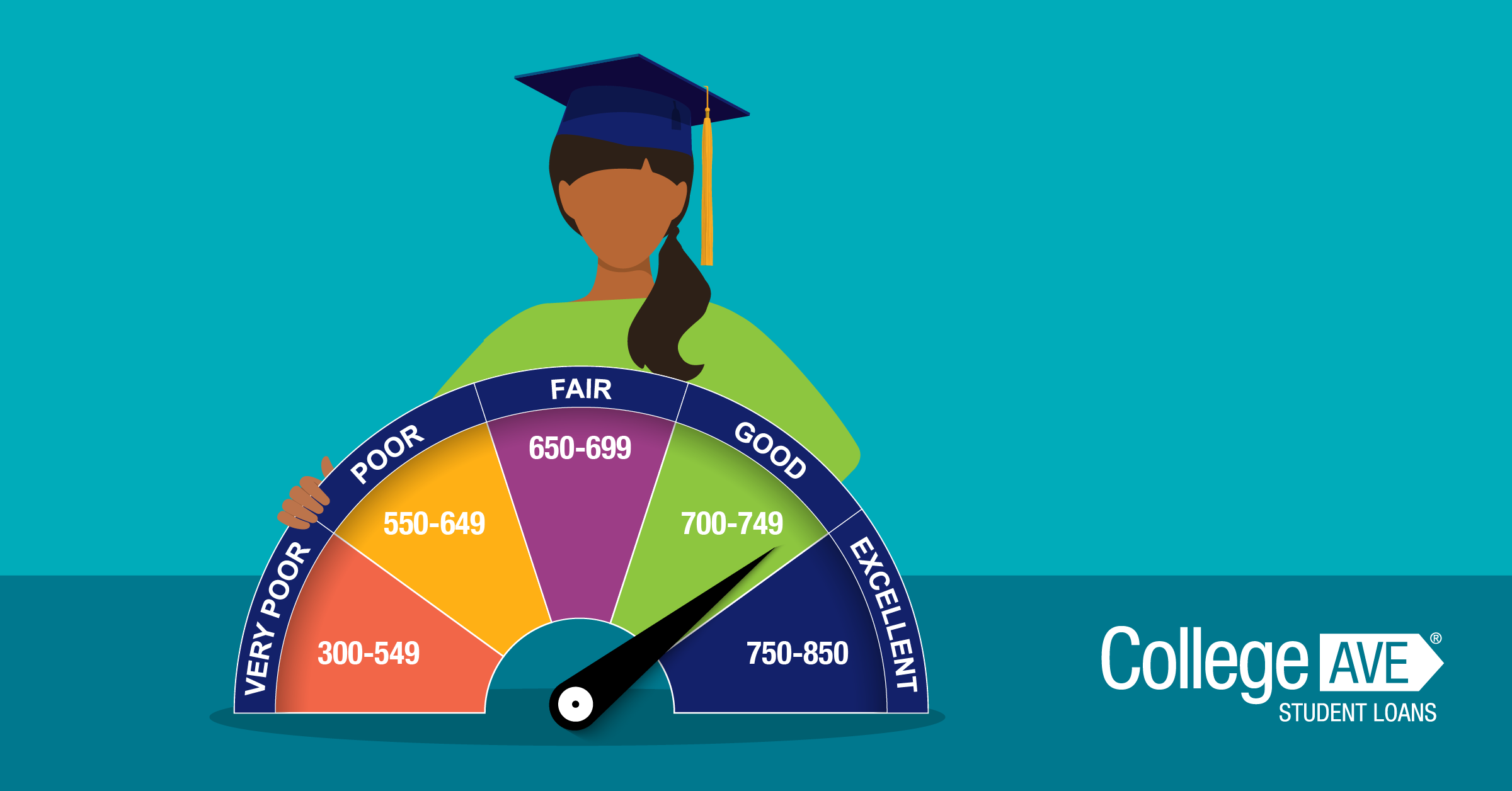

Credit card issuers look at many factors before approval for you to get a credit card. Your credit score is a factor, but not the only one. You should also consider your credit history and debt to income ratio. A low credit score or limited credit history may mean that your application is rejected. Credit card issuers will want to verify that you are a trustworthy borrower and have a track record of paying on time.

The first thing you need to do is review your credit report. All three consumer credit bureaus can give you a copy of your credit file for free. It is important to carefully read your report. Your credit score and payment history should be accurate. This will help you identify the best credit cards for your needs.

Credit Score Impact of recent credit application

You may be concerned about how applying for a credit card could affect your credit score. There are simple ways to minimize this impact. Avoiding too many applications at once is one of the easiest ways to reduce this impact. Applying for too many credit cards can lead to multiple hard inquiries that will affect your credit score. Instead, try applying for one card and waiting for it to be approved before making another one. If this isn't an option, you may want to consider applying for a personal loan instead.

Hard inquiries are a part of almost every new credit card application. These inquiries can lower your credit score by as much as five points, and they stay on your report for two years. If you submit multiple applications in a short time, the impact is greater. This is especially true for those with a poor credit history.

There are steps to take in order to improve your chances to be approved

There are steps that you can take to increase your chances for getting approved for credit cards. Check your credit report for any negative marks. If you see any, work to fix them as soon as possible. Another way to improve your credit score is to set up AutoPay for your credit cards. You can also become an authorized user for another credit card even if your credit history isn't good. This can help you build your credit fast.

The next step is to contact the credit card issuer to find out why your application was declined. On the denial letters, you will often find the contact information for your card issuer. You can reach the company by phone if you are unable to reach them. It is important to clearly explain why you were denied a card and that your payment history is good.