Perhaps you're wondering if a debit card can help build credit. In this article, we'll discuss the benefits and drawbacks of debit cards as a way to build credit. A debit card is not the only option. You may also be interested in a secured or prepaid credit card. We will specifically cover the GO2bank Secured Visa Credit Card.

Building credit using a debitcard

Building credit with a debit card is not the same as building credit with a credit card. While credit cards are the primary way to build credit, debit cards can still help you achieve your financial goals. These cards give you easy access to funds and allow you control your spending. However, you should be aware that these cards may have overdraft fees or you may be declined for a transaction.

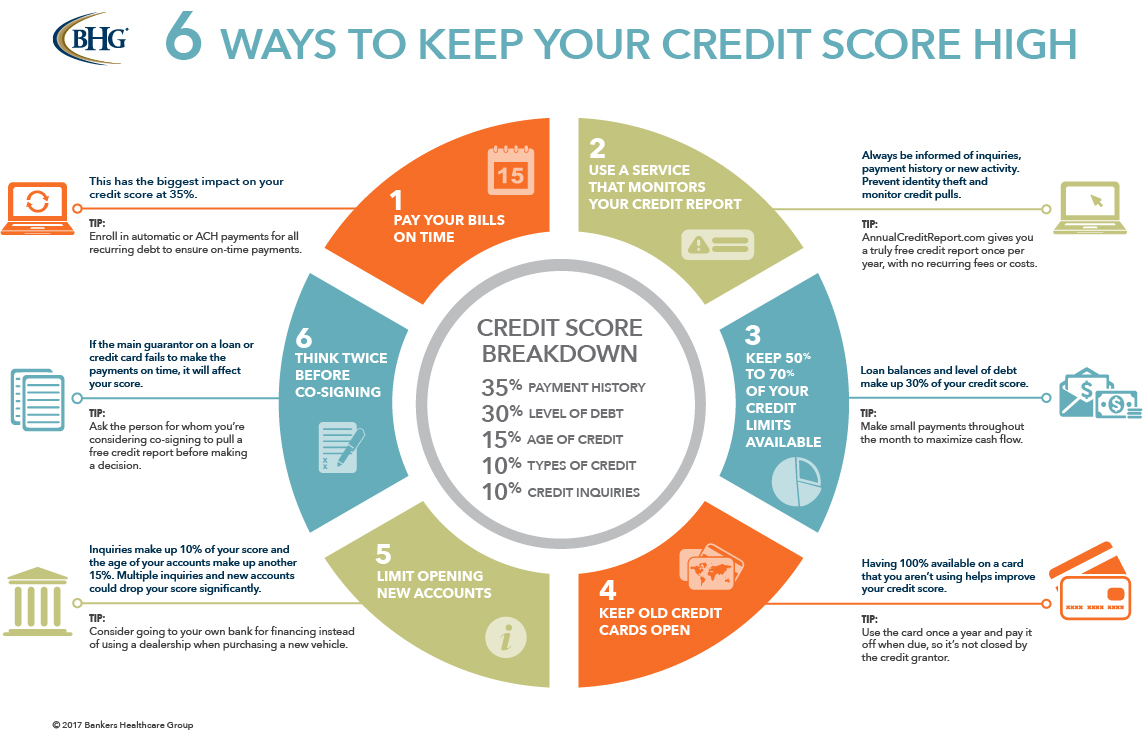

Credit cards and debit cards are important for credit building. Credit cards can improve your credit score. This is not possible with a debit card. Credit reports will not reflect debit card purchases. But, credit card purchases can affect your credit score. It is important to repay your credit cards on time to avoid paying high interest.

Prepaid cards increase credit

Prepaid debit cards do not build credit. Although they can be more convenient, prepaid debit cards don't improve a person’s credit score. The main difference between prepaid debit cards and credit cards is that you can only spend the money that has been added to the card. This means that cards with high credit scores are not the best options for you.

Secured cards enable you to build credit slowly. To build credit, you must pay your bills on time. Secured credit card providers report your payment history on a secured credit card to all three major credit reporting agencies. This will show future lenders that this is a responsible borrower.

Secured credit cards build credit

Secured credit cards are a good option for people who want to build credit and improve their score. They can be used in a similar way to regular credit cards and are quite easy to use. It is important to pay your bill on-time and keep your credit utilization low. You will see an improvement in your credit score if you maintain a track record of responsible behavior.

Secured credit is similar to a credit card but you don't spend the money. Instead, you deposit a security deposit. Secured credit cards usually require a $500 security deposit. The issuer can take money from your security deposit if you miss a payment.

GO2bank Secured Credit Card

The GO2bank Secured Visa Credit Card, a fantastic choice for anyone looking to build credit. This card offers fair value for money as there is no annual fee, and there is no minimum deposit. You also get a fixed APR, Visa payment network purchasing power, and a fixed APR. Responsible usage will help you build credit. This card is also part o the Green Dot Family, so it's a good option if you want to build your credit score and are concerned about your financial situation.

GO2bank has the support of Green Dot Bank which is a bank that serves 33 million customers. It was established to help people without a bank card or access to traditional financial institutions. In 2019, 5.4% percent of households didn't have any bank accounts. The GO2bank Secured Visa Credit Card allows these individuals to build their credit and open an accounts without having to pass a credit screening.

Extra credit card

The Extra card, a debit card that can be used at more than 10,000 branches across the country, is called the Extra card. It has a spending limit that is tied to the available balance in your checking account. Although you are permitted to spend as much as this limit allows, you should not exceed it. Your spend power is reported every day, and the company will report your total purchases to the credit bureaus. You can apply for the Extra card if you have good credit history.

Extra is a great choice for those who wish to build their credit through a debit-card. It reports to credit bureaus at each month's end, so you can use it to increase your credit score. A good credit score will allow you to apply for credit cards with better rewards and lower interest rates. This card also reports to Experian and Equifax.