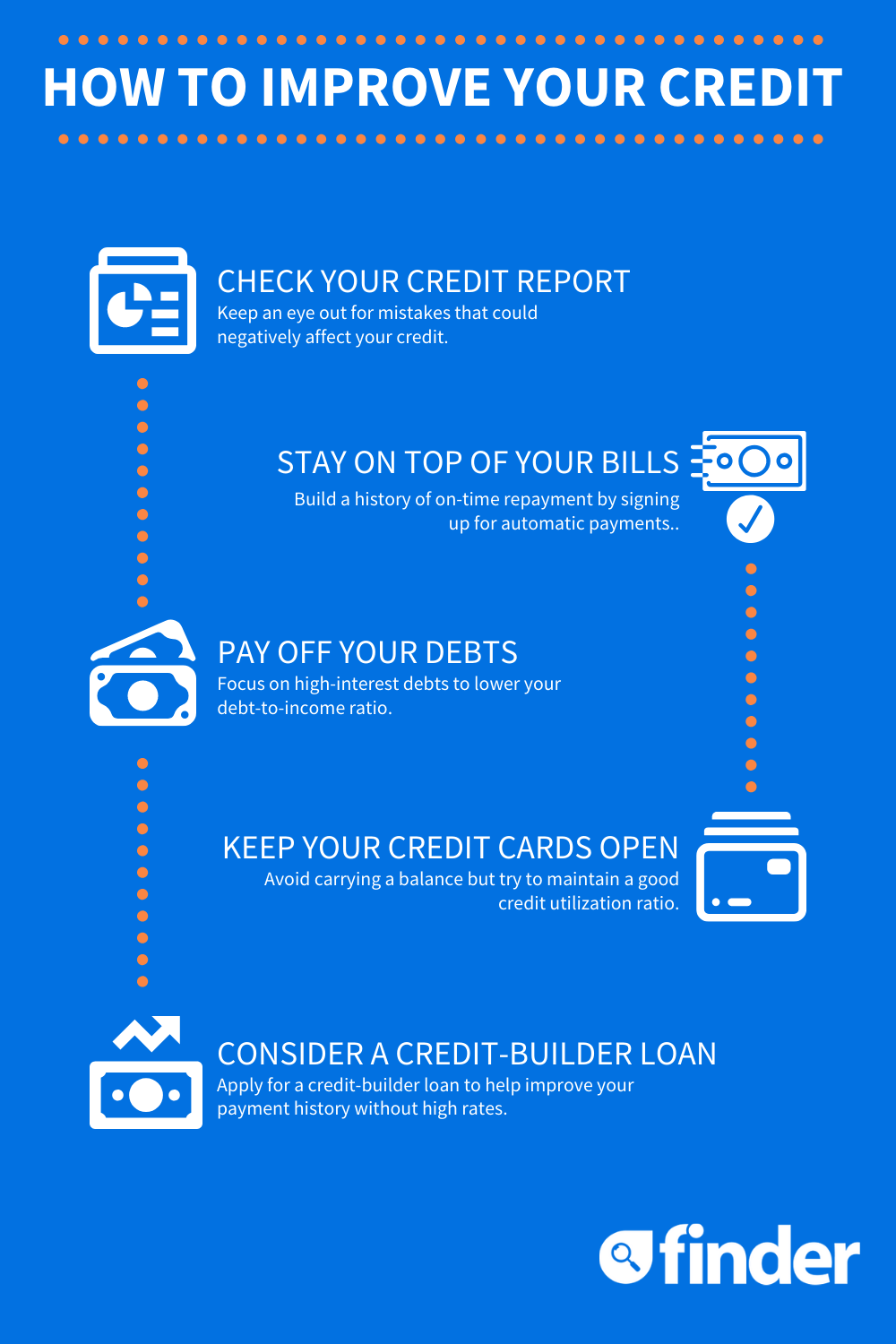

A low credit score can lead to negative consequences. Low credit scores can lead to higher interest rates, higher mortgage costs, and higher insurance premiums. You may also find it hard to get a loan. There are steps you could take to improve the credit score. You can improve your credit score by making timely payments on your accounts, limiting your credit utilization, and managing your finances carefully. These steps will help your credit score improve over time.

Low interest rate

A low credit score can make it difficult to get a credit card with a low interest rate. First, you need to learn about the scoring system. Then, there are many ways to improve your score. This will help you avoid paying higher interest rates on your cards and limit the amount of credit you take out. Using credit wisely and paying your bills on time will also improve your credit score. This process can take six to twelve months, but the payoff is increased access to credit at a lower cost.

You can also get a lower interest rate by paying down your debt. High interest rate credit cards can be a major burden on your finances. Bad credit can hinder you from saving enough money for the future. It can also make it more difficult to find a job. Employers and lenders are more likely to hire people with a good credit history.

Lower mortgage prices

Mortgage prices have risen over the past week, so it is important for consumers to do everything possible to lock in the lowest rate possible. Although there are many factors that influence the mortgage rate, improving your credit score can increase your chances to get the best possible mortgage rate. A 30-year fixed-rate mortgage with a 3.25% interest rate can make the difference quickly.

Zillow analysts estimated that a borrower of good credit would pay approximately $720 more on mortgage costs than a buyer of low credit. That difference is even greater in expensive markets.

Lower insurance premiums

Surprised? Your credit score can influence your insurance premiums. Your credit score is a major factor in insurance companies' premiums. If you have a good score, you could pay more for insurance. Insurance companies consider many factors when determining the premium they will charge, but credit scores are one of them.

Although some insurers do not use credit scores to determine rate rates, the majority of them do. Consumers with bad credit are likely to pay twice as much, or even triple the amount, than those with perfect credit. This is despite insurance companies not advertising that they use credit to determine premiums. It is misleading to claim that responsible drivers save money. In addition, consumers with clean records are more likely to get lower premiums than those with a history of traffic violations and accidents.

It is harder to obtain a loan

Low credit scores can make it difficult to get loans. There are still ways to improve your credit score. A short-term loan can be obtained from your bank. This will help to rebuild your credit score. Another option is to use your credit card to get a cash advance. Most credit cards have limits on the amount of cash they can advance, and you'll have to pay interest on the cash advance. Cash advance rates tend to be higher than other types purchase made with your card.

Lenders may require a larger down payment if you have low credit scores. They may also require a higher security deposit. You may also have to put a higher security deposit when renting a home. Lenders will charge a higher interest rate because you are taking more risk by renting a home. Unfortunately, this will reduce your money for other things.