Citi secured credit cards offer many benefits. You get no annual fee, flexible payment dates, and 0% interest. Some cards do not carry any liability for fraudulent purchases. Find out more about these credit cards and how they may benefit your financial life. A credit card that doesn’t help build credit is not something anyone wants.

No annual fees

Citi Secured Mastercard can be used worldwide at millions of locations. This card is for those with poor credit or limited credit. Its no-annual-fee option allows cardholders to focus on making on-time payments and building their credit score.

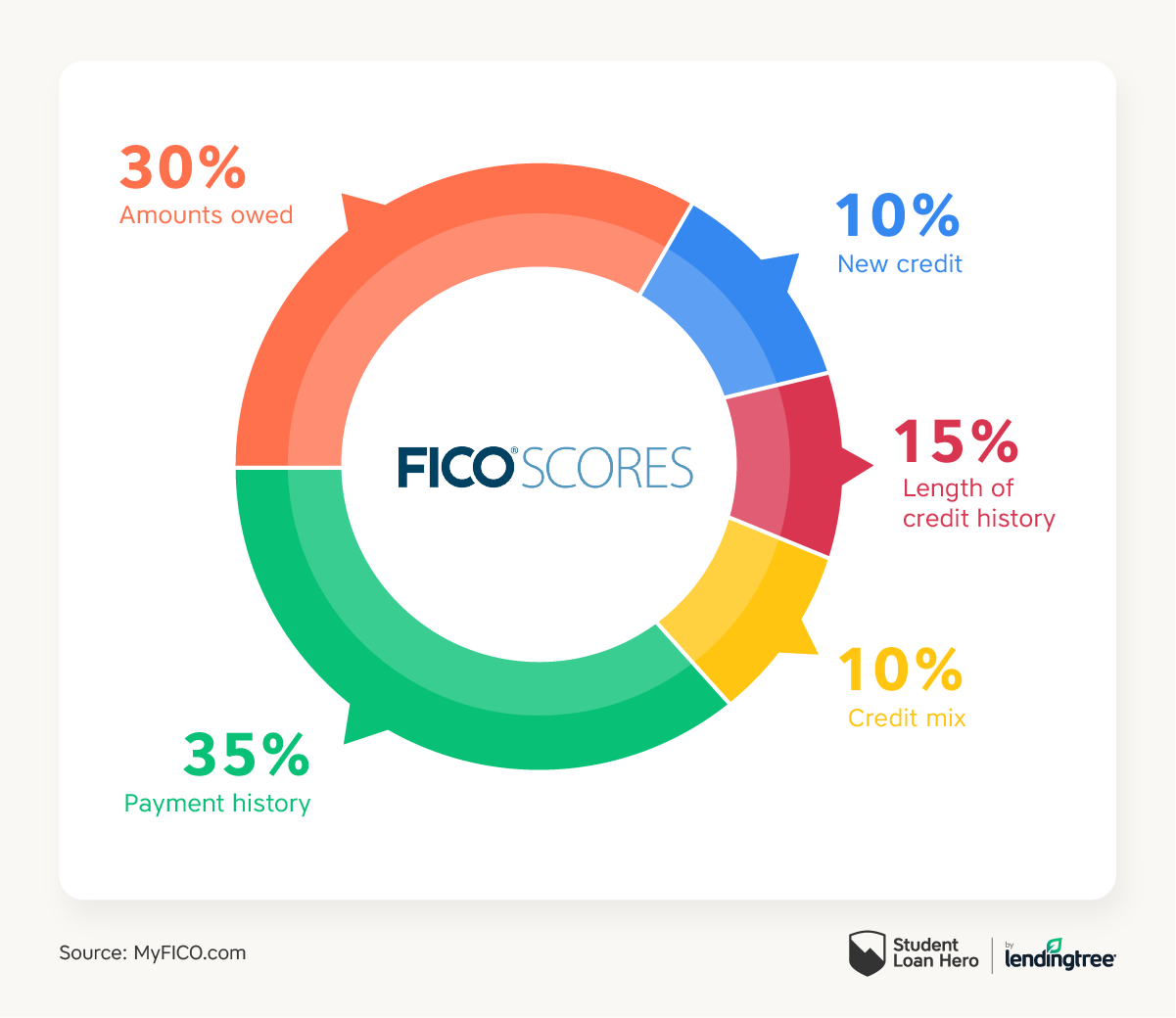

Citi Secured Mastercard is free of annual fees and a great way for you to build your credit history. You can access your FICO score online and it will report to all three major credit agencies every month. The card is accepted anywhere, and you don't have to pay an annual fee.

Flexible payment due dates

Citi credit cards offer flexible payment terms and can be helpful if you are having difficulty paying your monthly bills. These cards can give you more flexibility when it comes to how you pay. They also help you build your credit record. Auto Pay is a way to automatically pay your bills, so there's no need to worry about missing a payment.

Another perk of the card is that it reports your payment and spending activity to the major credit bureaus. This means that you can build credit and increase your credit score. Pay attention: You can damage your credit history if you miss a payment or use it for large purchases. Don't use your card to max it out, this will severely damage your credit score.

False purchases not covered by $0

You should have a credit line with zero liability for fraud purchases if there are concerns about you getting charged with fraudulent transactions. Different issuers have different zero liability policies. These are described on the website of each issuer. You can also call the company directly if you suspect your account has been abused. You can also monitor your card 24 hours a day and determine if the charge was fraudulent. You might also be able to receive secure messages or texts asking you to confirm purchases. However, if you're not able to verify a charge within sixty days, you may be responsible for the full amount.

A credit card that has zero liability for fraudulent purchases also offers other benefits, such as the flexibility of payment due dates or 24/7 customer service. Citi credit cards have zero liability for any unauthorized purchases. Citi Identity Theft Solutions provides free identity theft assistance, which can help you if someone steals your identity. A Citi card also routinely monitors your account for fraudulent activity and contacts you if suspicious activity is detected.

0% APR

A Citi secured credit card at 0% APR can help you rebuild credit if you have had credit problems in your past. The credit card requires a low deposit of $200 to $2,500, which is refundable if you don't want to use it. It has a variety of other advantages, including a user-friendly mobile app and flexible payment terms. Even though it doesn't give you rewards, a secured credit card is an excellent option for those with low credit scores or limited credit histories.

Citi will review your credit history and report on your account activity to credit bureaus. This can help you qualify for better interest rates. You must apply online for the card. It can take up to four weeks to receive a decision. You will need to wait seven to 10 business days until you receive your decision.

No foreign transaction fee

Citi Secured Mastercard offers excellent credit building and comes with no annual fees. All you have to do to get the card is deposit a security deposit of at least $200. You can get a credit limit up to $2,500 with the card. The card comes with balance transfer fees of 3% on the amount transferred, and a 3.3% foreign transaction fee.

Citi Secured Mastercard does not have an annual fee. It also has standard APR rates. It comes with a contactless payment chip for faster transactions. It offers exclusive offers on travel, dining, and entertainment. The card is not the most expensive, but it has many great benefits. Its cash back program is modest but it can add up to a substantial amount each year. The card's only problem is the foreign transaction fee.