Here are some steps to help you start credit with zero credit. First, be sure to reduce your expenses. Grocery store trips can be expensive. While you might feel tempted to use your debit cards, store credit cards usually have lower interest rates and credit limits. If you're planning to use a store card, make sure to make a plan to pay off the balance every month. You could lose your credit score if you don't pay the interest.

Applying to a creditcard without a creditcard

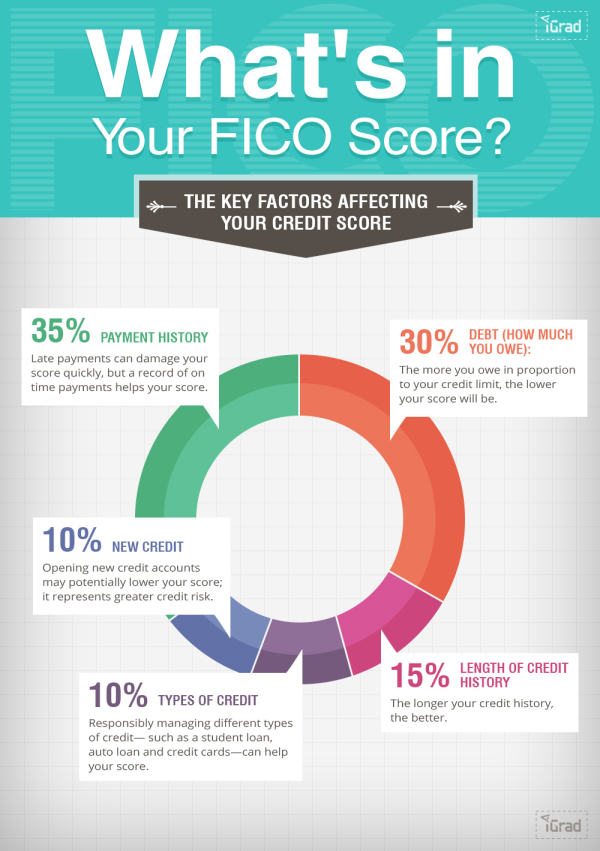

When you apply for a credit card, make sure you read the fine print. This will allow you to understand the annual fee as well as the interest rate and prevent you from falling into debt. You can establish credit quicker by responsibly using your credit card. Make sure to make all of your payments on time and keep your balance below 30% of your credit limit.

You may also apply for a secure card. A co-signer is required to deposit money as security for your credit limit. These cards usually have low credit limits and many banks don't report any activity to credit bureaus. However, a co-signer is still responsible for payments if the main cardholder fails to make them, and they can view statements on the cardholder's statement. However, late payments can affect the credit rating of the cosigner.

If you have bad credit, applying for a credit card may be a challenge. However, it is possible to get approved for a credit card despite a lack of credit history. It is easier to get approved for secured and starter cards for people who are just beginning to build credit. The first credit account you open will determine your credit score, and it is likely that you will start higher than 300.

Secured Credit Card: Discover it(r).

If you're looking to start building credit, the Discover it Secured Credit Card can be a great choice. This card allows you to have a low credit limit, but also offers cash back rewards that can add up over time. This card can help you build your credit by giving you 2% cash back on gas and restaurants purchases. Cash back can also be earned if you pay your bills on-time.

The Discover it(r) Secured credit card comes with a low security deposit, but it has more benefits than a traditional secured credit card. It offers flexible redemption options as well as a rewards program. Additionally, the fees are lower than most secured credit cards. The card comes with low fees and a See Terms APR. This is based on the prime rate.

Get a store creditcard

Store cards can be great if you have poor credit. They are available for easy access and offer money without any fees. They are not always reliable. These cards not only give you access to money for free, but they also allow you build large balances in a very short time.

Store cards require minimal credit scores and can be applied for instantly. However, you must not be under 18 years. Many stores prefer people who have good to moderate credit. Don't expect to be able to show off your credit score. A secured credit card or student card might be more suitable for you if your credit score is not high enough to get a traditional credit card.

You can build credit history with store cards, provided you make your payments on schedule and limit your utilization to 30%. In addition, a store credit card can be a decent savings tool, but you should be careful about which ones you choose.