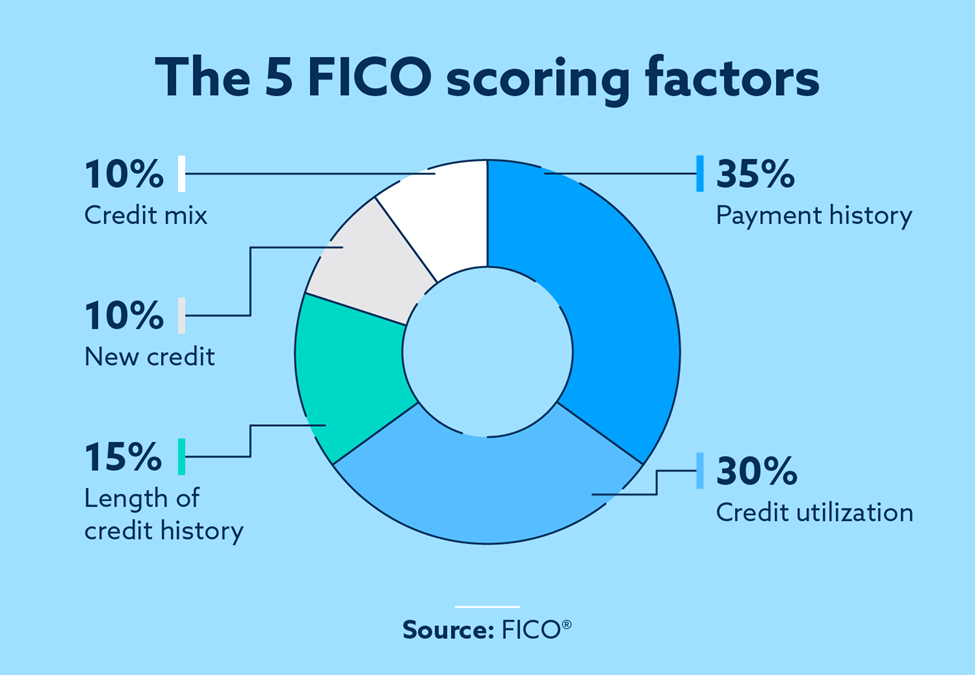

The FICO Score is a summary of your credit report that helps lenders make better decisions about you and your loan application. It measures your payment history, length of credit history, and amount of credit used. FICO Scores are calculated using information from credit reports. However, you can make a positive impact on your FICO Score by paying all your bills on time and not taking on too much debt.

Payment history

It is important to pay your bills in time to improve your credit score. A budget is a way to do this. Although this may mean that you have to make some sacrifices, you should try to pay all your bills in time. If you still have trouble making ends meets, you might consider applying for a credit line to help you pay your bills.

Credit history length

Your credit score is influenced by the length of your credit history. This score is calculated by taking the average of the age of all your accounts along with the date you used them most recently. You should note that accounts that are in good standing but not yet closed will not be included in your credit score for at least 10 years.

New credit

Your credit score is affected by many factors, including how many credit accounts you have. The length of your credit history accounts for about 15% of your score, and the longer it has been, the better. The amount of credit that you have is another factor that will impact your score. It accounts for 10%. This number includes how many new accounts you have opened and how many hard inquiries you made recently.

New credit accounts

The potential impact of opening a new credit card account on your FICO score is significant. You may have a history making late payments. Having multiple credit accounts could also negatively impact your FICO score. Your credit score will depend on several factors, including how often you make payments and how much of your available credit you use. If you are responsible with your credit, however, you can get a good score on your first account.

The history of renting

Your rental history can play a key role in your credit score and help you to build it. This information is used by lenders to calculate your Fico score. Fortunately, there are several ways to report your rental history. You can sign up for rent reporting services. These services will send your rental payments to the credit reporting agencies for you. This is a great method to build your credit and avoid interest rate and late fees.

Credit mix

Fico score, which is a number, is calculated by combining credit mix with credit utilization. Your credit mix is the primary determinant of your credit score. However, other factors, like your payment history or credit utilization ratio, can also impact your credit score. These factors can be improved in order to improve your overall credit score.