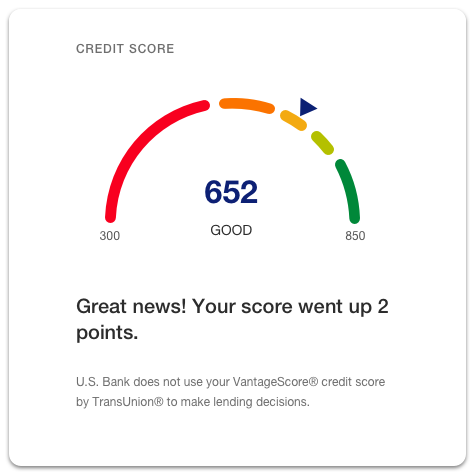

Building credit fast is a challenge for many people, especially if you're starting from scratch or have poor or no credit history. It's a long and tedious process but essential to your future financial security. It is essential to have good credit for a number of financial goals. These include renting an apt, purchasing a vehicle, securing mortgage and even obtaining a contract for your cell phone.

You can speed up the process by using smart tactics. Here are some ways you can build credit fast and improve your score.

1. Make every payment on time.

Paying your bills on-time is not only a matter for convenience. It is also the most important factor in determining your credit score. Your credit score can be negatively affected for years if you pay late.

2. Avoid having high credit card balances.

You should keep your credit usage ratio as low and as consistent as possible. This is the percent of your available credit that you use on revolving account types, like credit cards and credit lines. A credit utilization ratio over 30% can affect your credit rating.

3. Ask for a higher credit limit from your credit card issuer.

You might be eligible for a larger credit line if your payments are always on time and you're loyal to the company. Check your card's policies before you request an increase. Some card issuers may perform a hard credit inquiry that could temporarily lower your score.

4. A secured credit card can help you to build up your credit quickly.

If you're new to credit, using a secured card can be an easy way to build credit fast and establish a positive payment history. Secured credit cards usually offer a small credit limit in exchange for a refundable security deposit. After a few months of responsible usage, your secured credit card can be traded in for an unsecured one.

5. Credit agencies offer a variety of free services and tools.

There are plenty of free resources for establishing your credit, including websites that can help you request free copies of your credit reports from the three major bureaus: Equifax, Experian and TransUnion. Credit agencies can help you dispute inaccurate information, and repair your credit scores.

6. Credit report cleaning is a great way to fix errors and late payments.

There's no doubt that mistakes can affect your credit score and are often overlooked. You should always check your credit history for mistakes and make a dispute to get them fixed.

Your credit rating can be immediately improved by taking steps to fix any errors on your report or to add missing information. The number of errors, and your overall credit score, can determine how quickly you improve your score. It could increase by more than 100 points.