There are many credit card options for students with poor credit. These cards are useful for building your credit history and don't require you to pay high fees. But there are also some things to consider before applying for a card. You should be aware of annual fees and interest rates. You may not receive any rewards if you pay a high annual fee for some cards.

Rewarding students with student credit cards

A student credit cards is a great tool to help you build your credit while at school. Although these cards may not offer the same rewards as regular credit cards, they do provide valuable tools to monitor expenses and track your credit score. Students cards offer an additional benefit, such as a sign up bonus that can be helpful in paying for college expenses.

Students can get student credit cards at interest rates

A credit card should not have high interest rates. There are several ways to achieve this. First, get a card without an annual fee and no high foreign transaction fees. A second option is to not have to share the card with a parent/guardian. However, students need to remember that this option may have additional requirements.

Student credit cards: Annual fees

Students are eligible to apply for student credit card with low annual charges. You may also be eligible for high-quality purchase rewards with some cards. The most important thing to consider is whether or not you will be able to meet your monthly payment obligations. For those with a poor credit history, you may prefer to only have one card while you learn more about managing your credit.

Secured credit cards have very few rewards.

For those with poor credit or limited credit, secured student credit cards with negative credit can be a great choice. They do not usually offer interest or rewards for deposits. Some issuers will even cancel your account if you don't make the required payments.

Low limits on student credit cards

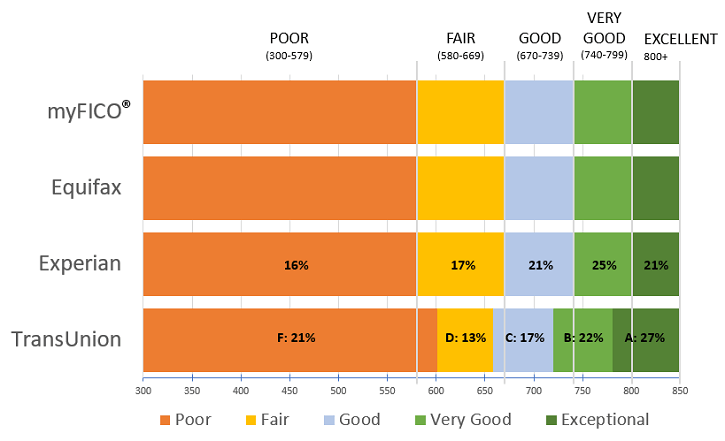

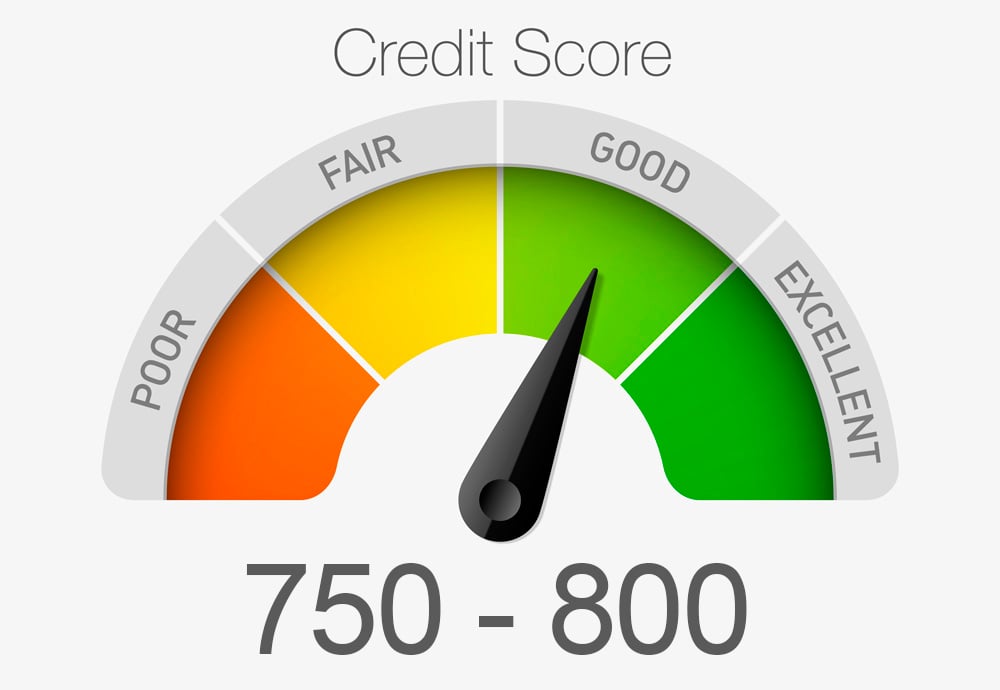

A student card with low limits may be an option for you if you have bad credit or need a credit card to cover tuition. These cards are unsecured, but can be helpful in rebuilding your credit score. You can improve your credit score by responsibly using them.

Prequalifying to student credit cards with low credit

There are options for students who have bad credit when looking for student credit cards. Some cards allow you to apply online for prequalification. This is a great way to build credit. A credit card with attractive terms can improve your credit score as well as get you a better rate of return.