Credit scores are determined by what type of credit you have. This "credit mix" is also known as your credit score. You can have "good", which means mortgages, and "bad", which means high-interest credit card debts and payday loans. The type of credit that you have will impact your score. Therefore, it is essential to fully understand what will affect your score.

Credit history length

The length of the credit history you have is an important aspect of your credit score. Credit scoring companies calculate this figure and it's the average age of all your credit cards. Your credit history will influence how high your score. A short credit history does not mean you cannot have good credit. A good way to build credit is to make on-time payments and avoid late payments.

One of the major factors that affect your score is your credit history. It's in the middle, between the age of accounts and the amount you have used of credit. However, it is important to remember that credit history can be as long as 10 years. Average credit scores for people with great credit are 711, so a longer credit history is a better way to keep your score high.

Payment history

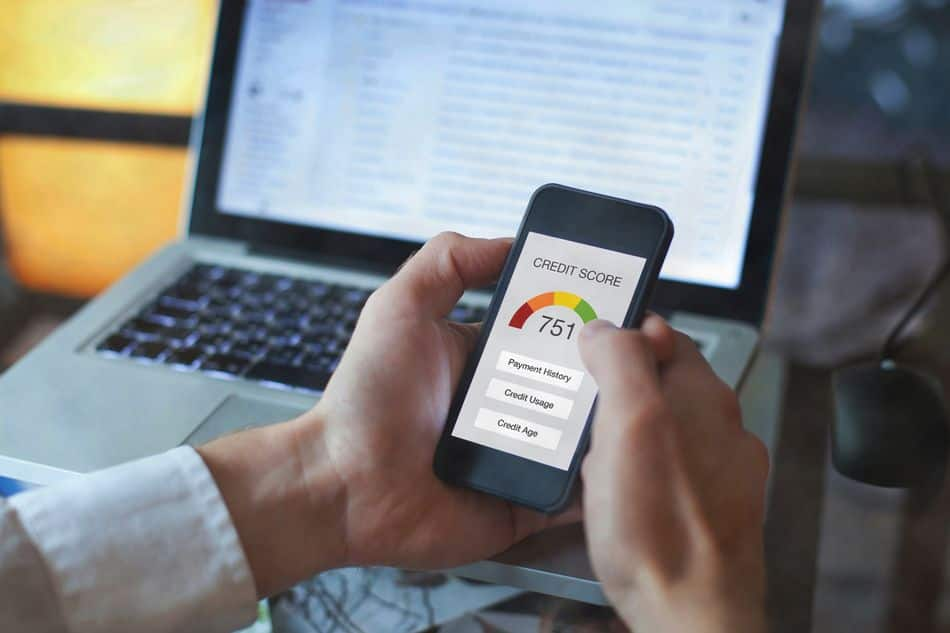

Your payment history plays a significant role in determining your credit score. Lenders use this score to make lending decisions. Your score will be affected if you are late paying your bills. Your score will drop if you don't pay your bills in time.

Your payment history reveals which accounts you were responsible for and when. This information contributes 35% to your credit score. Lenders prioritize your payment history because it tells them how likely you are to pay your debts. However, it is important to note that one or two late payments will not automatically hurt your score. It is possible to have a positive payment track that can outweigh any few late payments.

Credit utilization

Your credit utilization ratio is an important factor that can affect your credit score. This can help you determine if you are a high-spending customer or a low risk customer. It can also increase your chances of being approved for a loan. As a rule of thumb, you should use no more than 30% credit on revolving loans. You should also pay off your balances every month. Online credit scores can be viewed to help you get a better idea of your credit utilization.

Credit scores are affected by how much credit you use. Your credit score can be improved by having a balanced credit card. However, if your credit card has a high balance, it can negatively impact your credit utilization ratio. It is possible to improve your score by paying off your outstanding balances within the time frame.

Credit utilization does not include collections

Credit utilization is an important part of your credit score. It shows the scoring model how well credit management is going. High credit utilization could hurt your score. Best to keep credit utilization below 30% Credit utilization is affected by several factors. You might have too many loans or credit cards.

Remember that credit card debt represents a small portion of your total credit limit. Even if you have only used a small percentage of your credit available, you shouldn't worry about collections. Even if you have many high-limit cards, your total utilization ratio should not exceed 30%. This will allow thousands of dollars to be available in credit.

VantageScore

A VantageScore is affected by your payment history. It shows lenders you are capable of managing different types credit responsibly. Your credit utilization will be lower and your score will improve if you pay off your debts quickly. It is a good practice to keep your oldest credit accounts in good standing.

VantageScore considers several factors, such as payment history, debt types, and overall debt. Your payment history makes up approximately 35%, but your total debt is equally important. Credit utilization is also important. It's a good idea for balances to be 30% or less than your credit limit.