You might be concerned about your ability to rebuild credit after filing bankruptcy. Although it is understandable to want to open more credit lines, the most important thing to do to rebuild your credit is to repay all of your debts. In bankruptcy counseling programs, you should be able to learn about budgeting as well as ways to reduce your debt. In addition, nonprofit credit counseling agencies, such as those affiliated with the National Foundation for Credit Counseling, can provide you with guidance.

On-time payment of your bills

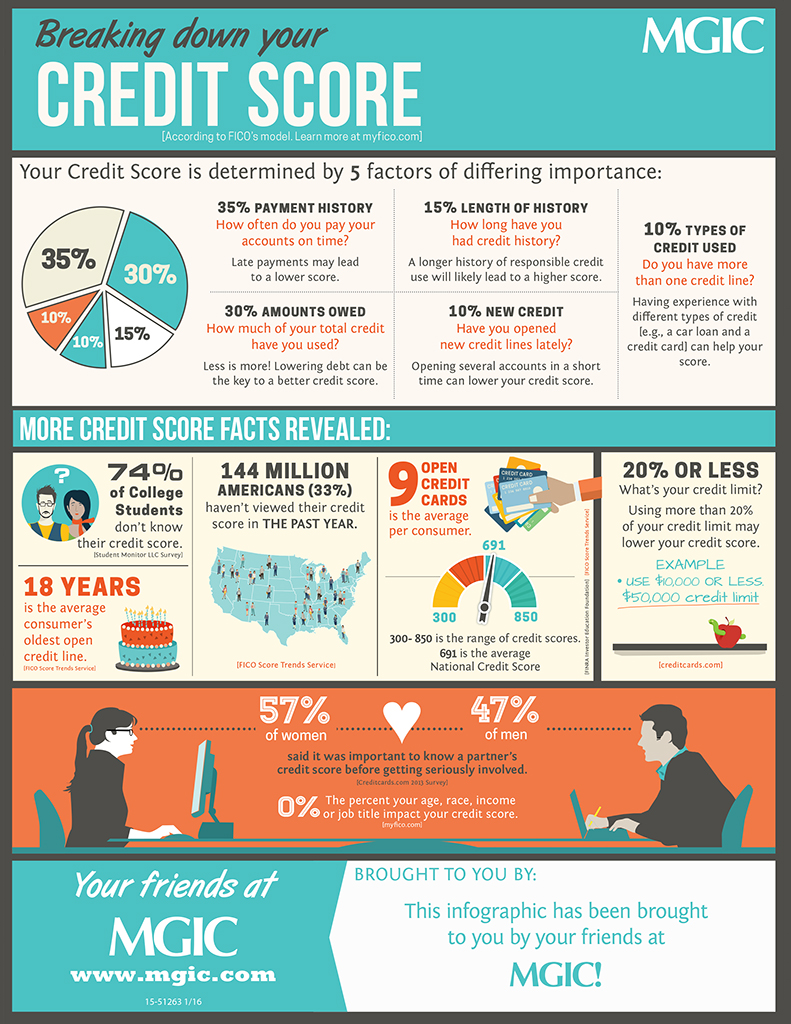

It is crucial to pay your bills on time when you are trying to repair credit after bankruptcy. Paying your bills on time is crucial to rebuild your credit. Your payment history accounts for 35% of your FICO Score. It is also a smart idea to limit your monthly costs. By limiting your monthly spending, you can keep on top of your bills and end the cycle of debt.

The best way to rebuild credit after bankruptcy is by paying off all outstanding debt. Once your debt is paid off, the next step is to build an emergency fund. It is best to spend less than your income. Therefore, it is important that you have enough money to cover unexpected expenses.

Secured credit cards

One of the best ways to rebuild credit after bankruptcy is to use a secured credit card. These cards require a deposit equal to or greater than the credit limit on the card. This deposit can't be refunded unless your card is closed or upgraded. These cards are a great way for you to build your credit score, and also establish solid credit histories.

This card is easy after bankruptcy, as the credit limit is only the amount of your security deposit. Unsecured credit cards on the other side will not require you to have a credit check and may be able to extend credit without your bankruptcy. The downside of these cards is the high fees and punishing interest rates.

Using Peer to Peer loans

Lenders are often wary of individuals who have declared bankruptcy. The reason is that their prior loans have been liquidated entirely or partially and they are now in serious financial trouble. It is possible to rebuild credit after bankruptcy, if you adhere to a few guidelines. To begin, you must be honest about what is happening and show evidence that your financial habits have changed. Also, you should prove that your money has been saved.

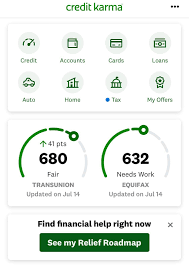

In order to rebuild credit after bankruptcy, it is essential that you have a clean credit report. Free copies of your credit reports can be obtained from all three major bureaus. Then, take steps to correct any errors.

Offsetting negative information on your credit report

While bankruptcy can cause damage to your credit history it is possible to rebuild it. There are several steps you can take immediately to restore your credit after bankruptcy filings. Even if you think you have terrible credit, you can start building it again in just a few months.

Write to credit reporting agencies to dispute incorrect information. Fair Credit Reporting Act states that credit reporting agencies are required to investigate disputes and rectify inaccuracies. The bureaus can also provide a note explaining their side of the story that will appear on future credit reports. You will have the information for seven years. Therefore, it's crucial to act now.

Getting a new credit card

It's possible to get a new credit card to rebuild your credit after bankruptcy. Credit card companies must report payment activity to credit bureaus. However, a low utilization rate will help you rebuild credit more quickly. It's better to have zero balance and to pay it off immediately.

When rebuilding your credit after bankruptcy, you must show lenders that you're responsible with money. Your credit score will be largely affected by your credit card payment history. Therefore, it is important to manage credit cards responsibly. While credit cards can be used to pay for things you can easily afford, you should not spend too much and end up paying high APRs.