Your credit score is a number that is determined by a formula that is based on several factors. These factors include payment history as well as the length of your credit history. Credit scores are higher the longer you credit history. People with short credit histories typically have low credit scores.

People with poor credit have very little credit.

You probably don't have a high credit score if you haven't used credit for a while. It is vital that you have a good credit rating if you wish to borrow future money. Even if you have never used a credit card, there are steps you can take to repair your situation.

Generally, people with no credit score are either young or have never used credit. Hispanic and black individuals have lower credit scores than Asian and white people. This is because 25% of Hispanics and 25% of Black people never had the chance to build strong credit histories. Low income people are also disproportionately affected by the credit system. In fact, 45% of adults in low-income areas have an unscored credit history.

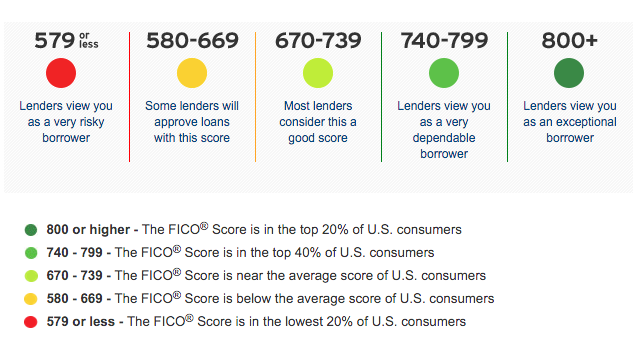

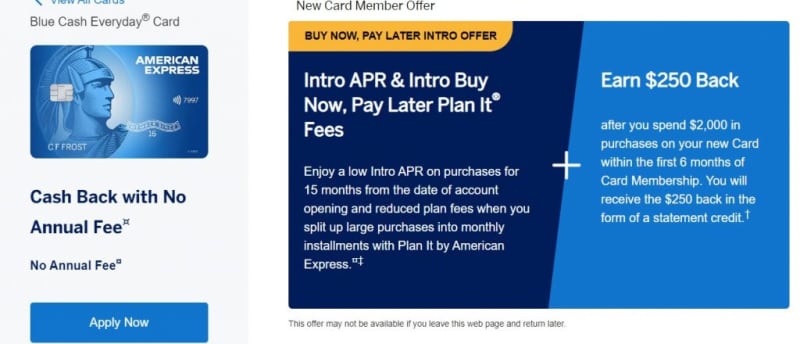

It is hard to get approved by lenders or credit card companies if you do not have a strong credit history. Bad credit history may result in higher interest rate and lower approval rates for loans. A secured credit card can be used by people with bad credit to improve their credit score.

People with a very short credit history

The length of credit history is one of the factors that determines your FICO credit score (FICO). Each category is assigned a weight. Your overall score will be based on how well each has been performed. Your overall score will be 35% if you include the payment history category. This category is critical because lenders want proof that you can pay your monthly payments on time. Your score can be quickly damaged by irresponsibility.

Although age has a significant impact on your score however, payment history is far more important. Each year you make a payment, your score will increase. When you reach seven year, your score will be the highest.

Credit scores that are higher for people with a longer credit history tend to be higher.

Credit score can be affected greatly by how long your credit history has been. The longer your history is, the higher your credit score will be. Credit scoring models consider both your oldest accounts and your newest accounts. They also take into account the average age for all your accounts. A longer credit record will allow you to build better habits and maintain credit.

Your credit history is responsible for 15% of your total score. An extended credit history means that you have paid on time and have not made late payments in recent times. Your credit utilization ratio, which measures how often you use your credit, is an important part of your credit score. Lenders are looking for a credit utilization rate below 30%. This indicates that you are only using credit when it is really necessary.

Credit score is influenced by the length of your credit history. However, the age of your accounts does not matter as much. It is the amount owed by lenders that matters. Pay your bills on time, and keep your credit card balances low. This is the best way to build credit history. You can expect to see a natural increase in your credit score if your credit is managed responsibly.